Designing for financial collaboration

Problem

In India, families coordinate finances across multiple accounts and generations, yet every financial apps take an individualistic approach.

Joint accounts are often cited as the standard solution for shared finances, but existing studies show they are rarely used for collaboration. They cannot accommodate the fluid way families negotiate spending, share access, and pool resources informally.

Opportunity

HMW design financial systems to support collaboration in a way that reflects lived practices?

Goals

- Document collaborative financial practices across diverse Indian household structures

- Identify gaps between user needs and current digital financial system capabilities

- Formulate design principles to enable support and collaboration in financial digital applications

Process

Diary Studies

Interviews

Thematic Analysis

Co-Design Workshops

Synthesis

Design Recommendations

Phase 1: Diary Studies

I recruited 11 women across India who actively manage household finances, from three-generation homes to young professionals living with parents, to couples managing money together.

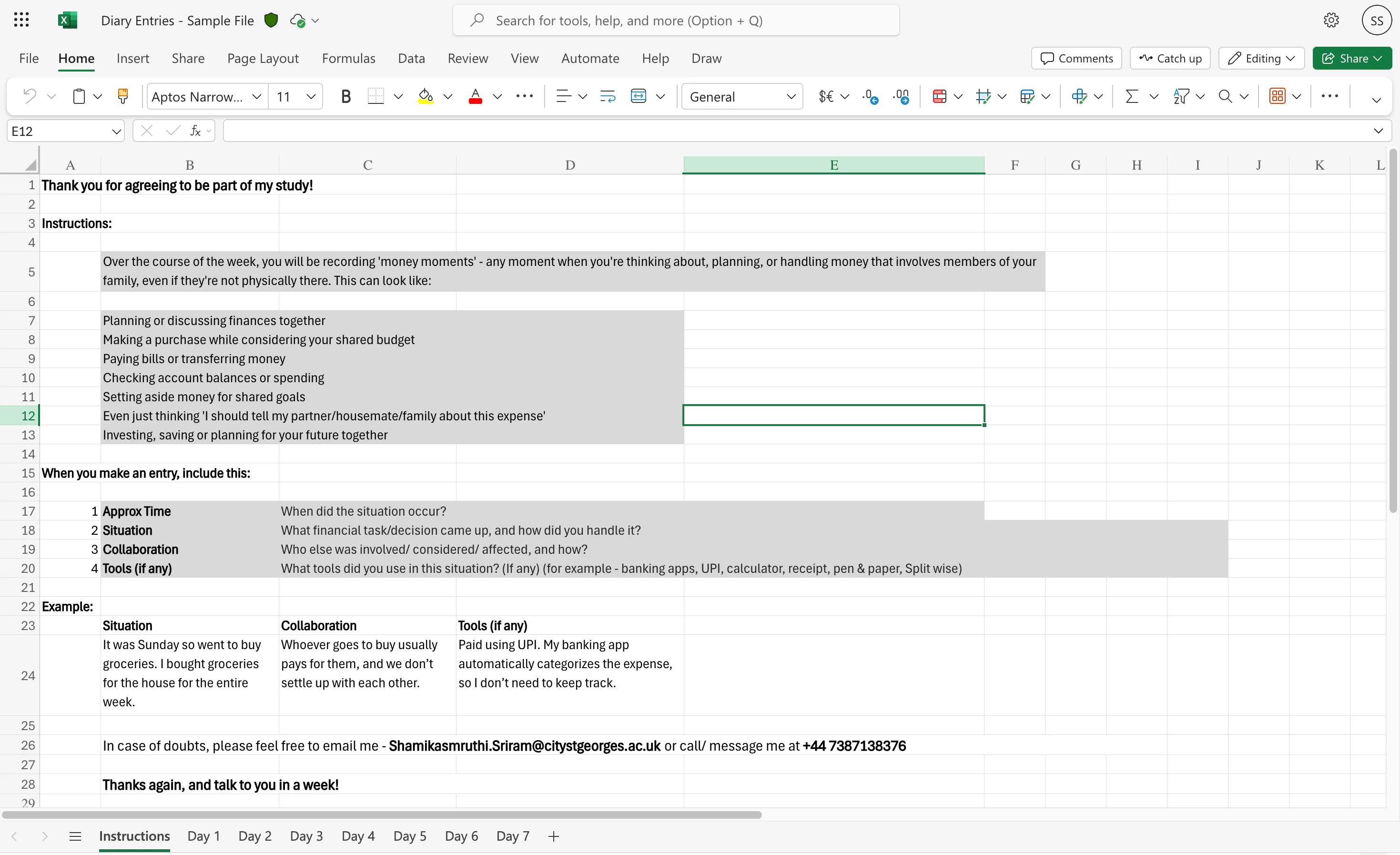

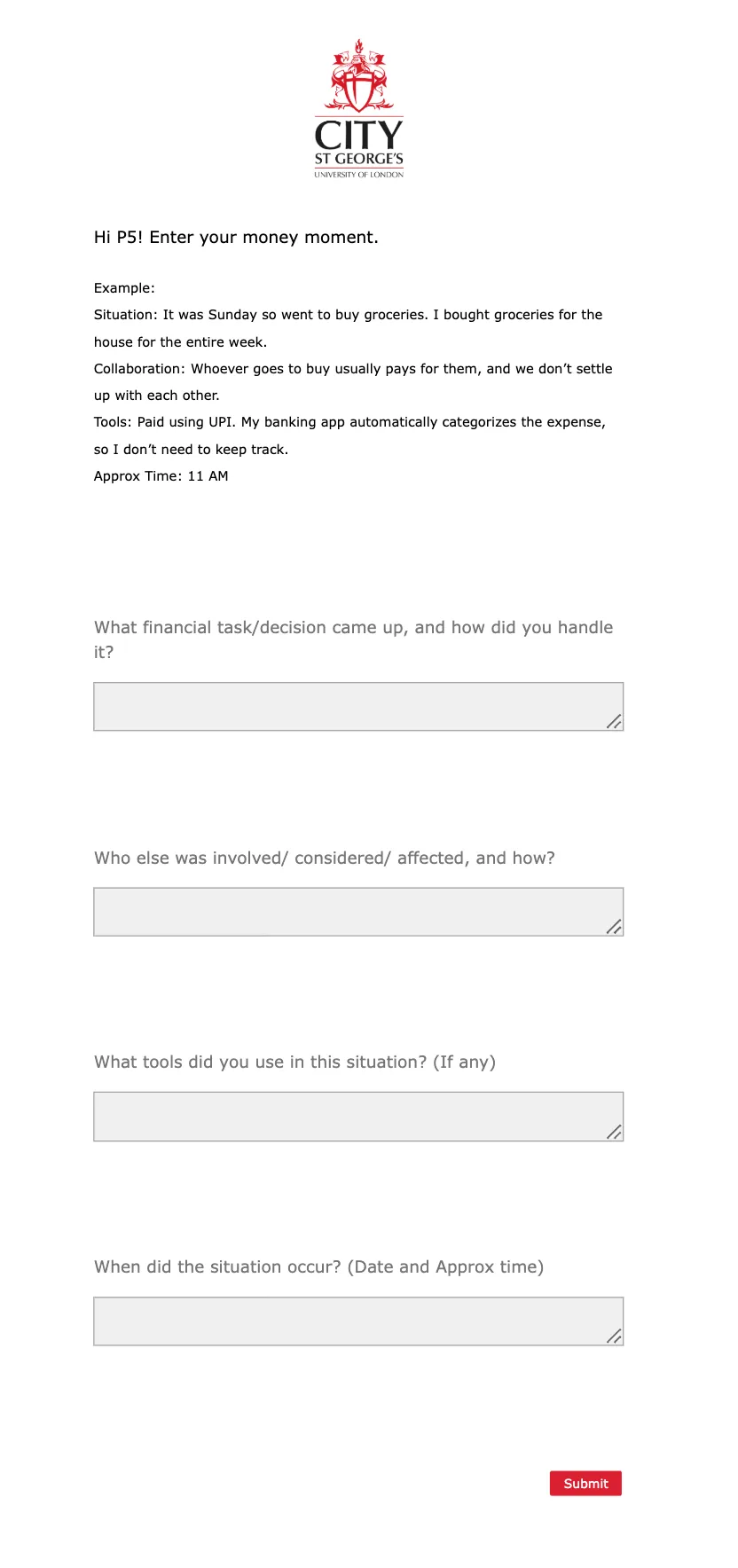

Participants captured moments of financial collaboration over one week—planning expenses, paying bills, negotiating budgets, or thinking “I should tell my partner about this purchase.” They chose their format (Excel, WhatsApp, or forms) to make logging feel natural.

Excel format: Structured logging with predefined categories

WhatsApp format: Quick voice notes and text messages

Form format: Guided prompts for consistent entries

I collected 101 entries spanning quick grocery decisions to long-term investment planning. Daily check-ins sustained engagement. After each week, I conducted 45-minute interviews to understand not just what happened, but why households operate this way.

Thematic analysis in NVivo revealed five patterns around responsibility division, tool preferences, and the tracking challenges households face.

Phase 2: Co-Design Workshops

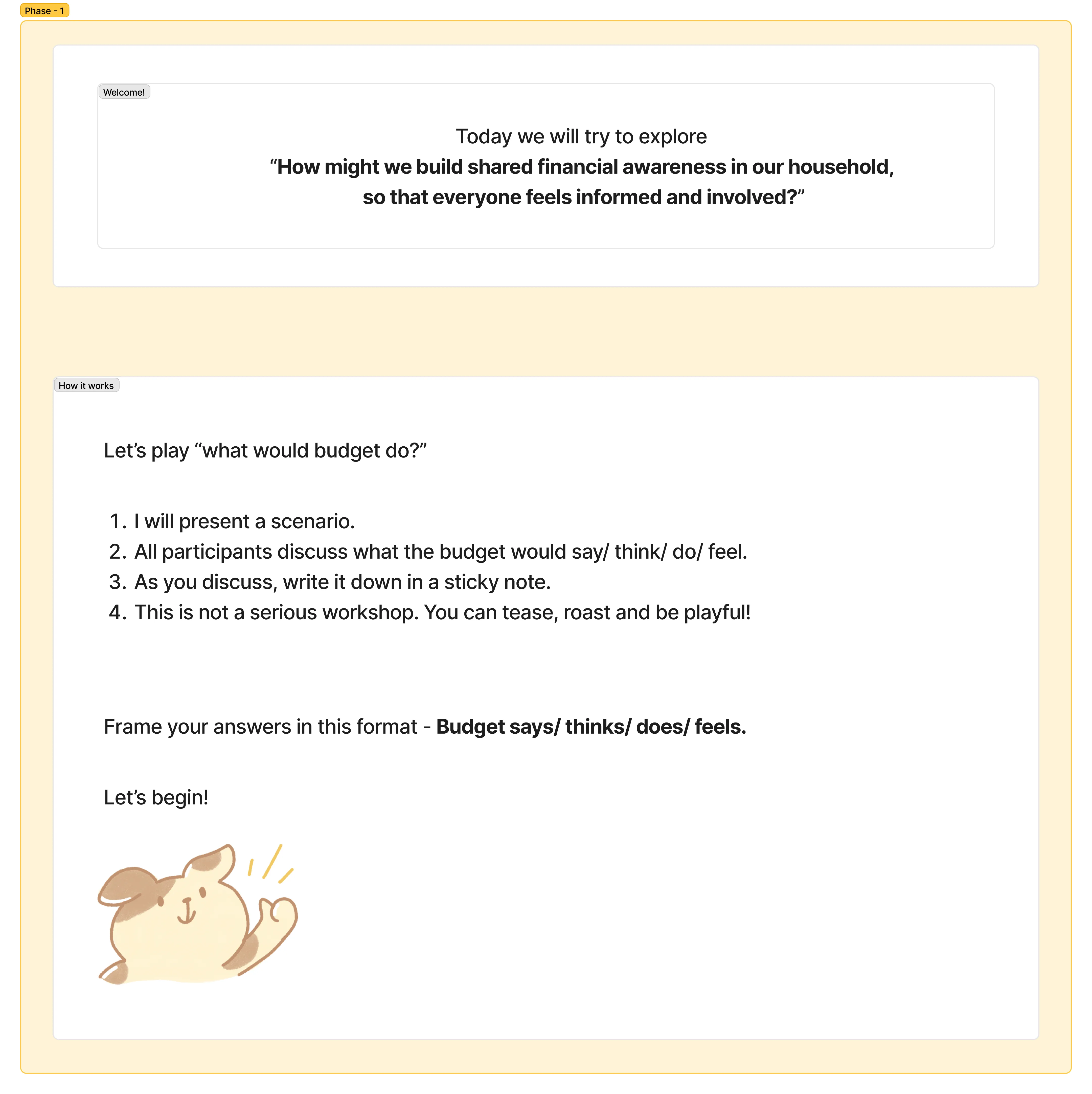

I ran three remote workshops (3 participants each) exploring “How might we build financial awareness so everyone feels involved and informed?”

In the first activity, groups discussed four real scenarios from the diary studies. What should the “budget system” say, think, do, and feel? Scenarios addressed visibility gaps, accountability needs, and technical comfort levels.

Figjam board explaining Activity 1

Participants discussing and writing notes for accountability and budgeting scenarios

In the second activity, participants individually visualized their ideal system using images and notes on FigJam boards.

Figjam board explaining Activity 2

Participants indivdually visualized a collaborative system

Analysis mapped their ideas across financial management stages (Plan, Act, Track, Analyze, Adjust) and the spectrum of human control versus system automation. Participants wanted tools that support their decisions without removing agency.

Findings

Findings are organized to show how families actually collaborate alongside the system limitations they face.

Shared Money, Individual Systems

Indian families treat money collectively, sharing passwords and cards. Women manage household finances by receiving contributions, paying bills, raising spending awareness. Tasks divide by tech-savviness: young adults handle auto-pay, parents manage manual bills.

Banks treat password-sharing as policy violations. Joint accounts are too rigid for fluid collaboration. Systems enforce separation, forcing risky informal workarounds.

Scattered Visibility

Multiple people using multiple accounts, cards, and apps create incomplete household pictures. Participants forgot to track expenses, lost track across platforms, found themselves asking “where did the money go?”

No joint accounts means no collective view. Systems don’t sync household information. Participants wanted categorical summaries and bill payment notifications, not itemized transaction transparency.

Accessibility Barriers

Older members intimidated by complicated interfaces. Large learning curves deter use. Security and privacy concerns prevent linking accounts to third-party apps.

Systems assume uniform digital literacy. Complicated tools exclude family members from participating in household financial management.

Tracking Burden

Everyone wanted spending analysis. No one wanted constant manual logging. Households use “good enough” methods—rough limits, general awareness. They need lightweight accountability (who paid what) without rigorous monitoring.

Transaction data already exists in bank statements but categorization is inaccurate. Participants reluctant to grant third-party apps access. Systems demand manual entry or nothing.

Design Recommendations

1. “Shared Money, Individual Systems” → Support collaborative visibility without enforcing transparency

Design configurable broadcasts where members choose which updates to share (rent paid, grocery spending). Provide periodic summaries showing categorical patterns rather than itemized transactions.

2. “Scattered Visibility” + “Accessibility Barriers” → Design for universal accessibility

Integrate with familiar channels: WhatsApp notifications or cross-device widgets. Present data in multiple formats (graphical and textual) with progressive disclosure. Offer simple and advanced views accommodating different comfort levels.

3. “Tracking Burden” → Reduce manual effort by leveraging existing data

Allow users to appropriate existing systems through custom categories and configurable alerts. Add social tracking features (tag who paid) for lightweight accountability.

Core philosophy: Adapt existing systems to fit collaborative practices rather than forcing households to adopt entirely new tools.

Reflection

Participants didn’t perceive individualized banking as frustrating. They’d built collaborative workarounds around rigid systems. The real issue isn’t user dissatisfaction but systemic invisibility of household practices in financial design. This suggests the solution isn’t reinventing banking but making existing tools appropriable for collaboration.

Future Directions

AI-enabled financial collaboration holds promise but requires careful exploration of consent, trust, and household autonomy. How might AI act as a “fifth household member”, a co-planner, that assists without controlling? What safeguards prevent harmful advice for vulnerable users?

If your work explores this, please send a message! I’m interested in exploring the intersection of AI, finance and trust.